child trust fund

This amount rises to 500 for children from families who receive full child tax credit. The accounts were replaced by Junior ISAs.

|

| Child Trust Funds And Isas |

Flash forward 20 years and the 18-year-old is now approaching 40 with little money left and no means to support himself.

. Fund value at December 2020 811. Funded programs have fiscal and programmatic reporting requirements and responsibilities that The Childrens Trust regularly tracks. I have 3 grandchildren each with a child trust funds this post refers to one of them. A Trust is a legal relationship in which an individual or institution known as the Trustee holds assets subject to a legal obligation to keep or use the assets for the benefit of another known as the Beneficiary.

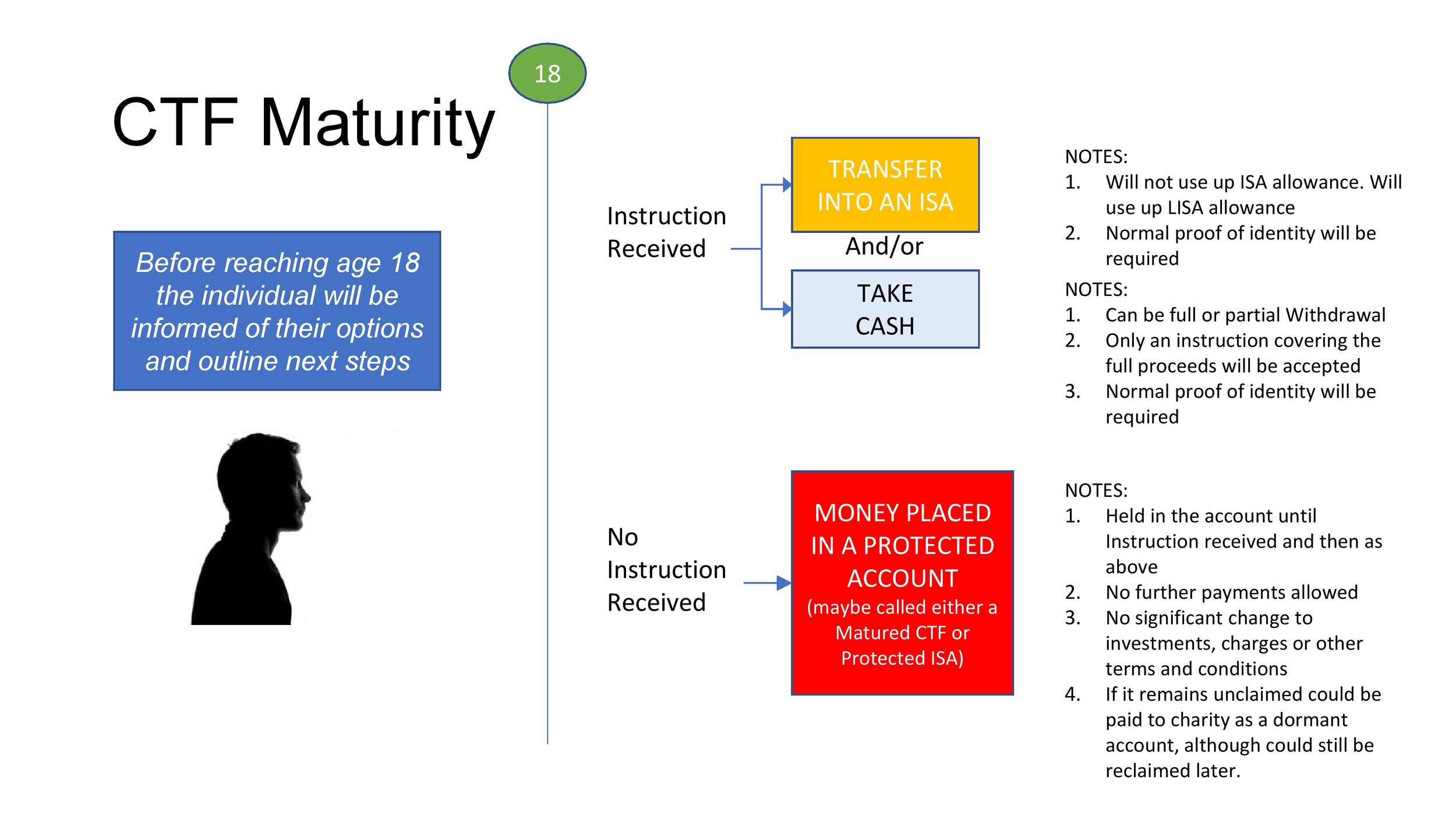

On your childs 18th birthday the Child Trust Fund matures. Invest in your childs future. What is a Child Trust Fund. You can find lost.

A child trust fund CTF is a long-term savings or investment account for children in the United Kingdom. Children born between September 2002 and January 2011 were given a 250 voucher by the Labour government to invest in a tax-free savings. With ISA you can transfer in any amount of money from your Child Trust Fund and then invest up to the annual ISA subscription limit of 20000. They received a voucher worth between.

Transferred in 01012017 794. Before you can tell us what you want to do with your money you need to become the owner of your Child Trust Fund. A trust will guarantee that funds will be available during your childrens time of dependency as well as when they are adults. A cash account still available for transfers in from other providers but not available for children born before 31082002 or after 03012011.

Since there are various types of trusts it. A Child Trust Fund is a savings account for children born between 1 September 2002 and 2 January 2011. No more money can be added. This will take the place of your parentguardian who are currently looking after it on your behalf.

In this way you can create a method by which money will be. An SNTC Trust is a necessary infrastructure to ensure your loved one receives the gifts under your will insurance andor CPF. LISA on the other hand only. You or your child can add up to 9000 a year to a Child Trust Fund.

For general questions to top up your Child Trust Fund or updating contact details you can call us on 0345 300 2585. Telephone lines open Monday-Friday 8am. Overview of the Child Trust FundA Child Trust Fund CTF is a savingThe guidance notes and legislationThe guidance notes are for providerContacting HMRCThere is online guidance ab See more. Our Child Trust Fund is a.

Your child automatically takes over the account. Value at December 2021. How to Set Up a Trust Fund for a Child. On the childs 7th birthday the Government will make a further payment into your childs Child Trust.

The process of setting up a Trust Fund for your children doesnt have to be complicated time consuming or expensive. If your child is under 16 youll need their Unique Reference Number - you can find this on letters from HMRC or Department for. Create separate shares for kids in their 20s. Use the online form to ask HMRC who provides your Child Trust Fund.

The five Child Trust Fund need-to-knows 1. Theyve since been replaced by Junior ISAs but those with existing Child Trust. This includes a continuous learning and improvement. The UK Government introduced the Child Trust Fund with the aim of ensuring that every child has savings by their eighteenth birthday.

Relay UK 18001 0345 300 2585. Most people with kids who. For more information about Trust Funds and different types of Trusts check out our in-depth article What Is a Trust in Estate Planning. It really can be simple and streamlined.

You can register to take over your CTF when you turn 16. New accounts can no longer be created as of 2011 but existing accounts can receive new money. A child trust fund can be established to set aside funds for college tuition living expenses healthcare costs and to pass along family inheritance. Child Trust Fund stakeholder account Originally set up by the government a Child Trust Fund CTF is a long-term tax-free savings account for children.

Child Trust Funds CTFs were available for children born between 1 September 2002 and 2 January 2011 as a way to save for their future. Your child can either. Interest is tax-free but this is not the benefit it once was. Take out the.

The cash is locked away until your child turns 18 but they can then spend it as they wish.

|

| 9bn Bonanza Begins As Child Trust Funds Come Of Age Child Trust Funds The Guardian |

|

| Everything You Need To Now About Child Trust Funds |

|

| The Ohio Children S Trust Fund Investing In Strong Communities Healthy Families And Safe Children Beech Acres |

|

| Children S Trust Fund Of Alabama Makes More Than 450 000 In Grants To Birmingham Area Nonprofits Al Com |

|

| Child Trust Funds Low Incomes Tax Reform Group |

Post a Comment for "child trust fund"